Trading stocks is pretty fun, but in Canada, it’ll also be pretty expensive. Almost all stock brokers will charge a trading commission, one anywhere from 5 to 15 dollars. One exception, the only one, in fact, is Wealthsimple. It’s the only no-fee stock broker in Canada. But is it any good? I’ll take a look at the fees (they’re still there), the features, the user experience and whether or not Wealthsimple is worth your time.

Eligibility

Before we get into the details, it’s worth covering who can open a Wealthsimple Trade account. To register you must:

- Be a resident of Canada, and either be a citizen of Canada or hold a valid Canadian visa.

- Have a valid Social Insurance Number.

- Be the age of majority in your province. Depending on where you live, it will be either 18 years of age or 19 years of age.

It’ll take some time to register, and you’ll have to provide some employment details, but it’s a fairly straightforward process. I’d say that you can get it done in just under 10 minutes.

Features

While Wealthsimple offers a large lineup of products, we’ll focus on Wealthsimple Trade, their no-fee investment platform.

Using Wealthsimple Trade, you can, in theory, purchase stocks traded on the TSX, the TSXV, the NYSE, the NASDAQ, NEO, the CSE and the BATS exchange. In practice, while most were listed, I found some were missing. Unfortunately, it is not possible to trade shares on European and Asian exchanges, nor is it possible to trade options.

TYou can hold your stocks, and your money, in an unregistered account, an RRSP or a TFSA. There are no minimum balances with Wealthsimple, meaning that you can get started with whatever you’re comfortable with, even if it’s only a dollar.

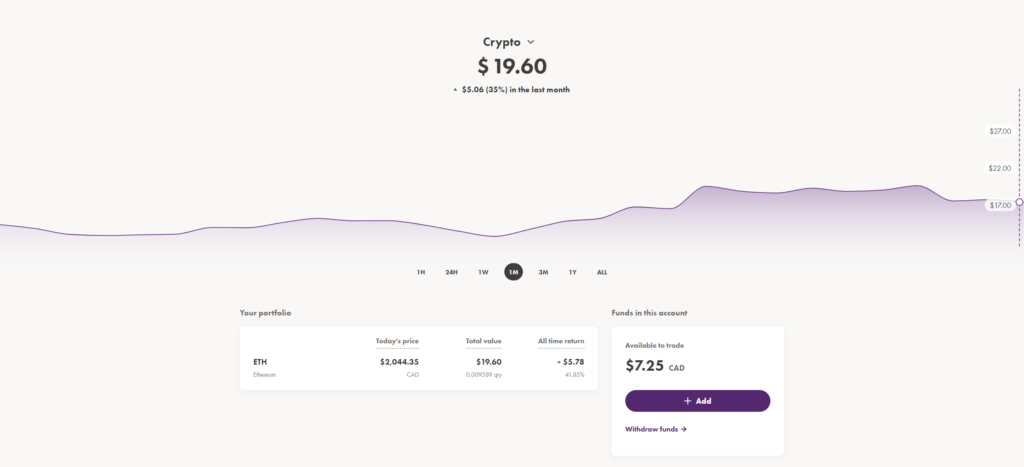

Alongside stocks, you can also buy and sell over 50 different cryptocurrencies. You’ll be given a separate account to hold your cryptocurrencies. Note that you can only hold your cryptocurrencies in Canadian dollars.

Depending on your account balance, you’ll be able to instantly deposit a certain sum of money into your trading account. Basic users will be able to instantly deposit a minimum of $1,500, up to $5,000. Premium users will be able to instantly deposit between $5,000 and $25,000. Your instant deposit rests once every three business days. If you make a deposit over the instant deposit limit, your money will be available to trade within 3-5 business days.

You can deposit this money from any chequing or savings account or via wire transfer.

User Experience

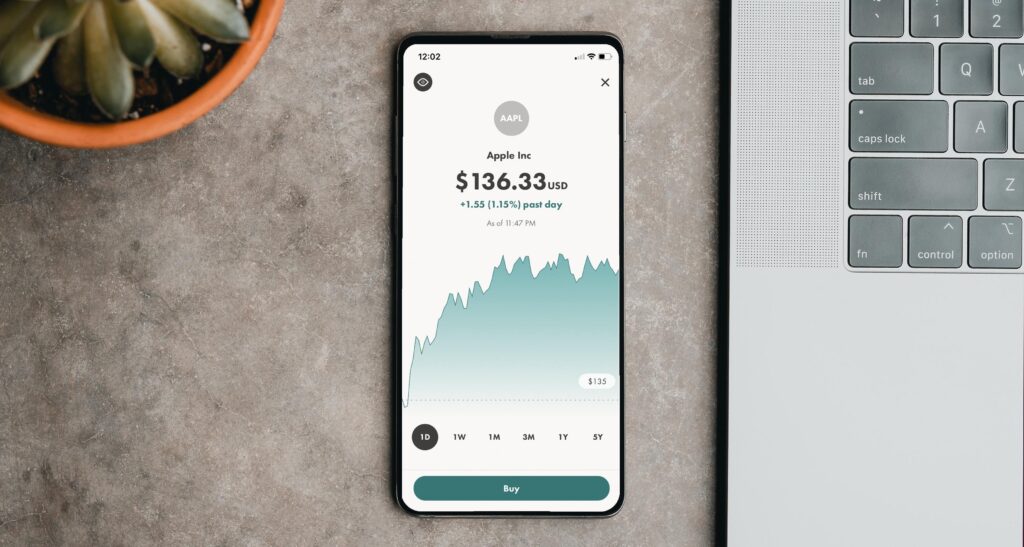

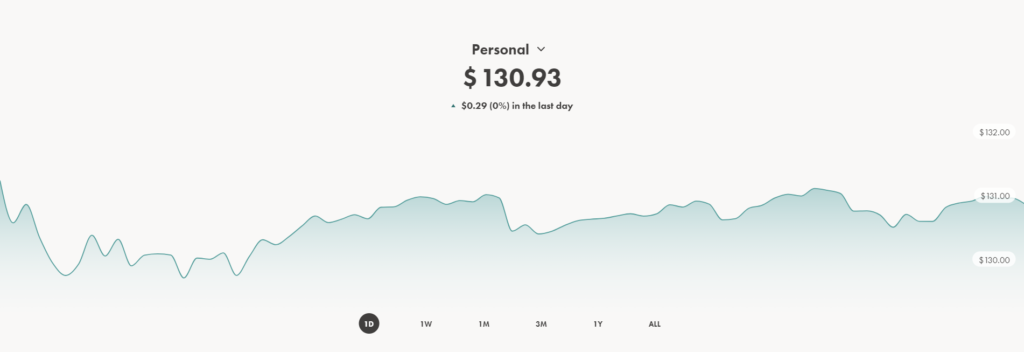

One of Wealthsimple’s main selling points is a straightforward and minimalistic user experience. It’s been designed for simplicity, and it does very well. Your portfolio consists of a simple green bar showing its value, and the stocks you are holding. With Trade Plus, you can switch between your USD and your CAD accounts through a toggle switch.

As opposed to other brokers, which employ advanced layouts and complex navigation systems, Wealthsimple chooses to go for a minimalistic design. The colours are simple, the layout is easy to comprehend there’s not much data to look at.

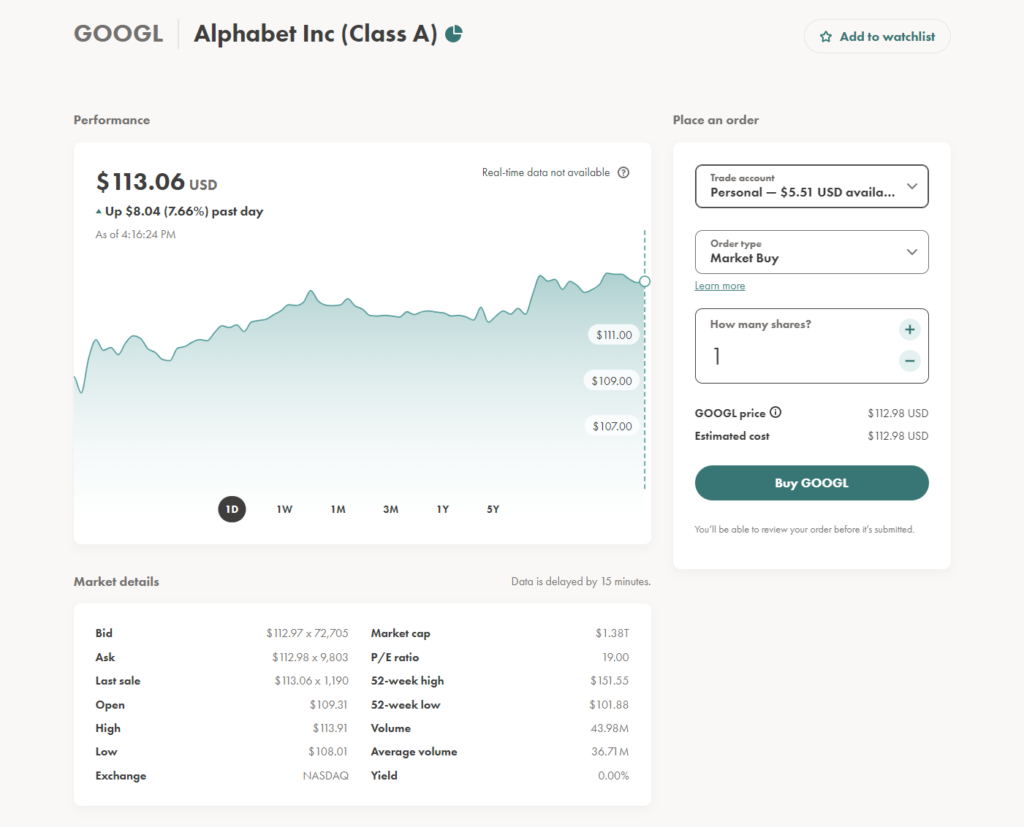

Buying a stock with Wealthsimple is very easy. Simply use the search bar in the navigation menu, search your stock, choose the amount and the order type and make the purchase. Spending your money with Wealthsimple shouldn’t take more than one or two minutes.

A major problem I found with Wealthsimple is that they delay the stock prices by 15 minutes. You’ll still buy and sell stocks at the real price, but you’ll have to switch between Wealthsimple and a separate platform whenever making a purchase.

Pricing and Fees

Wealthsimple brands itself as a no-fee stock broker, the only one in Canada, to be exact. This is technically true – you won’t have to pay any trading fees when buying or selling stocks, and it is free to open an account. However, that doesn’t mean you won’t have to pay anything. Wealthsimple’s free plan only allows you to hold money in Canadian dollars. If you’re trading American stocks, you’ll have to pay a 1.5% currency conversion fee each time you buy or sell shares.

There are some additional fees with Wealthsimple. You’ll have to pay $20 for a paper account statement, $30 for a wire transfer and $75 per hour for special requests and investigations. However, the average user won’t have to pay any of these.

Trade Plus – Is It Worth It?

While Wealthsimple is free, if you choose to do so, you can pay $10 a month for a premium subscription, Trade Plus. With Trade Plus, you won’t have to deal with many of the problems I’ve complained about earlier.

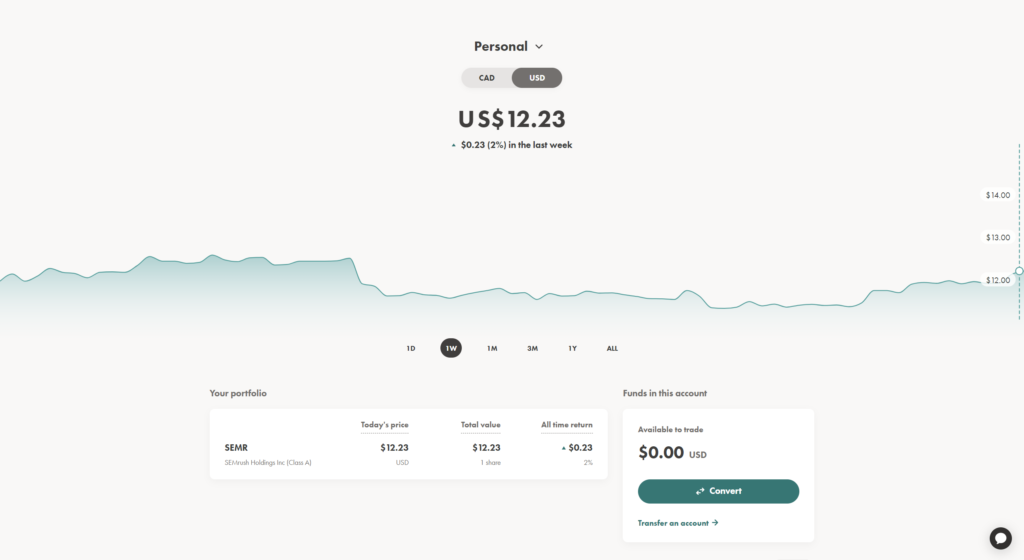

One of Trade Plus’s main selling points is the US dollar account. Remember those currency conversion fees you’ll have to pay whenever you buy or sell US stocks? With Trade Plus, you’ll be able to hold your money in US dollars, as well as in Canadian dollars. You’ll get two accounts within your existing account, one denominated in US dollars and the other in Canadian dollars. You can easily transfer cash between these two accounts, for a modest 1.5% currency conversion fee, of course.

Alongside your USD account, you’ll also get live stock quotes, instead of those delayed by 15 minutes. You can even deposit up to $5000 and have it available to trade instantly. You also won’t have to pay any foreign exchange fees.

Customer Support

Like most web-based financial institutions, Wealthsimple doesn’t have any physical locations. Customer service can be reached via live chat from 8 am to 8 pm EST from Monday to Friday, and from 9 am to 6 pm EST on Saturdays and Sundays. You can also reach them by phone throughout those same hours. You can also reach them through a support ticket 24/7, and expect to receive a response within around a few days.

Pros and Cons

- No trading fees, ever!

- A very easy-to-use interface, great for beginners.

- No account minimums.

- Works both on the web, and through mobile apps.

- CIPF protection up to a million dollars.

- A premium subscription is available for just $10 per month and will fix some of the problems mentioned below.

- Unless you’re using Trade Plus, you can’t hold your money in USD, and will get hit with a 1.5% currency conversion fee whenever trading US stocks (unless you pay for Trade Plus).

- Lack of advanced trading data or features.

- There’s a 15-minute delay on stock quotes (unless you pay for Trade Plus).

- There’s a limit on how much money you can deposit and have instantly available to trade.

Frequently Asked Questions

– How does Wealthsimple make money?

While Wealthsimple doesn’t charge any brokerage fees, they do charge that pesky currency conversion fee on US stocks. They also offer a 10$-a-month premium subscription.

– Is Wealthsimple trustworthy?

While it will depend on what you consider “trustworthy”, I’d say you can trust Wealthsimple with your money and your personal information. Your funds will be protected under CIPF for up to a million dollars, and your data is secured by a 256-bit SSL certificate. There should be no major risk in giving them your SIN and other details.