To trade stocks, you’ll want a good stockbroker, and with so many in Canada, it can be hard to choose. With over 30 billion dollars under management and 25 years in business, Questrade is one of Canada’s most popular stockbrokers. In this review, we’ll take an in-depth look at Questrade, the fees you’ll pay, the trading experience and whether or not it really is Canada’s number one stockbroker.

Features

Your money can be in either an unregistered account or a variety of registered accounts such as RRSPs, RESPs, TFSAs and margin accounts. You can also open a dedicated forex and CFD account. For most people, though, a non registered account, RRSP or TFSA should do just fine. The money you deposit into these accounts can be held in either CAD or USD. Unfortunately, you’ll be charged a 1.45% currency conversion fee when switching between the two.

A standard account will allow you to trade on both US and Canadian markets. They also allow you trade during extended hours on US markets, from 7 am to 8 pm EST. You can also buy and sell precious metals, enter IPOs, buy bonds, and much more.

Pricing

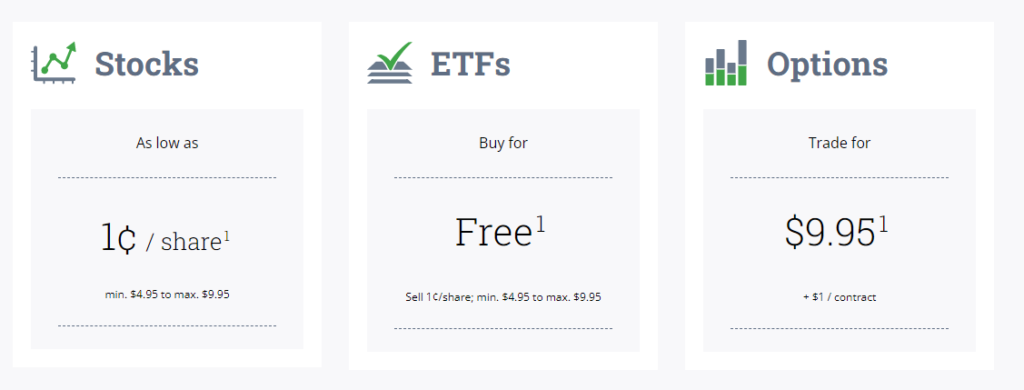

Part of Questrade’s appeal is the low pricing. While most Canadian stockbrokers charge upwards of $10 per trade, Questrade uses variable pricing. You’ll only pay a penny per share you trade using Questrade. Seem too good to be true? It is. While you will, in fact, pay a one-penny commission per share bought or sold, there’s a minimum of $4.95 and a maximum of $9.95 on commissions.

This means that if you trade a single stock, you’ll be charged $4.95. If you trade, say, 600 of them, you’ll be charged $6, a penny per share bought or sold. And if you trade a million shares, you’ll be charged $9.95, as it is the commission cap. You can trade Canadian and American ETFs for free. Options will cost $9.95, plus one dollar per contract. Mutual funds will cost $9.95 per trade, and IPOs are free, although there is a $5,000 minimum purchase. Same goes for bonds and GICs. Precious metals will cost $19.95 per trade.

There are no monthly fees and no inactivity fees, with the exception of an RESP with a balance of less than $15,000. In that case, you’ll be charged $50 per year.

There is, unfortunately, a minimum required balance of $1,000 before you can start trading. If you’re not willing to commit that amount, than Questrade is not right for you. If you are ready, than you’ll enjoy a dynamic lineup of features and a powerful trading experience.

Active Trader Pricing

If you plan on making a lot of trades, and are an experienced investor, you may want to take a look at Questrade’s active trader pricing. For a monthly fee, they’ll lower trade comissions and give you more data on stocks.

There are two different pricing options to choose from: fixed and variable. Fixed pricing, the most popular option according to Questrade, will reduce your trade comissions to $4.95 per trade, and lower options down to $4.95 plus $0.75 per contract. The variable pricing will charge you $0.01 per share you buy or sell, with a minimum comission of $0.01 and a maximum of $6.95. Options will cost $6.95 plus $0.75 per contract.

If you want active trader commission plans, you’ll have to purchase an advanced market data package. There are two, one for US exchanges and one for Canadian exchanges. Both cost $89.95 per month, although the US package is in USD.

Both packages are eligible for fee rebates. If you spend more than $48.95 in comissions in a month, you’ll get an automatic $19.95 rebate on the monthly fee. Spend more than $399.95 on commissions, and there’ll be no monthly fee at all!

User Experience

Having personally used Questrade for over 6 months, I can say that the entire user experience, from buying and selling stocks to viewing your portfolio, is a rather enjoyable one. Questrade has three different trading experiences, with three different traders in mind.

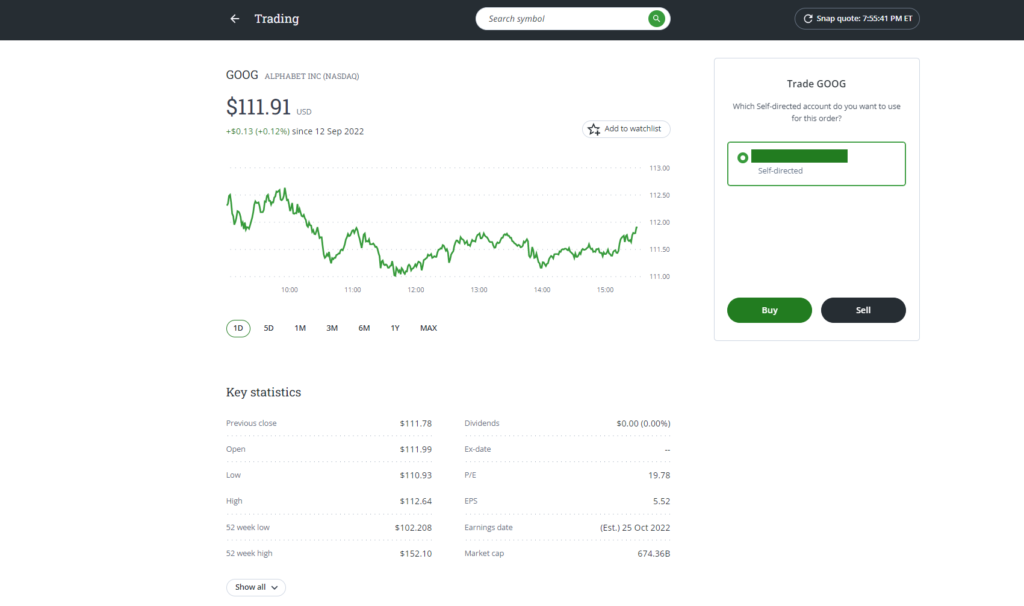

The overall design of the trading interface is minimalistic, with the stock price taking up the bulk of your attention and some key statistics tucked in below. If you want to buy or sell a stock, the obvious “Buy” and “Sell” buttons are quite hard to miss.

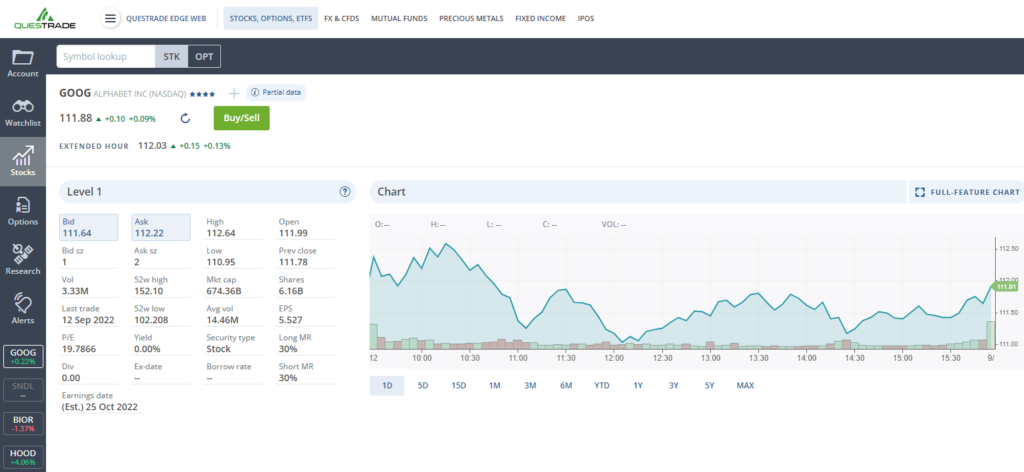

That’s not all, though. There are, in fact, two separate trading interfaces you can use. One, the default, is called Questrade Trading and is the main web-based platform. It offers basic stock data and is probably the one that most Questrade customers will find themselves using. Than there’s Questrade Edge, a more advanced platform with more data.

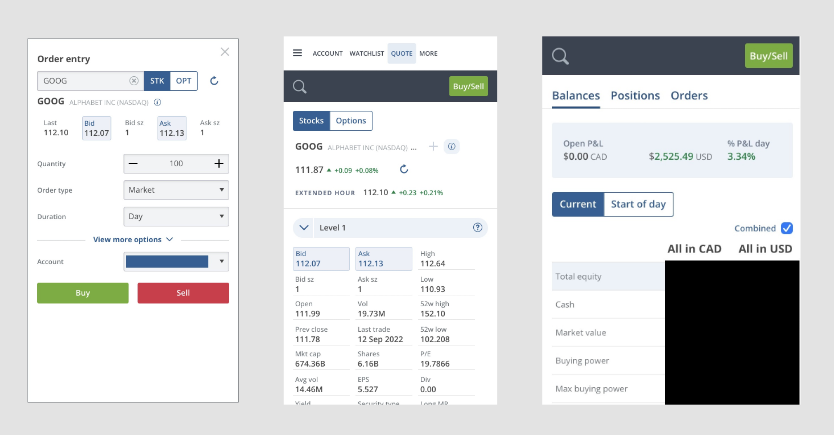

Questrade Edge a little busier and sports a less simple design when compared to the non-Edge Questrade, but the overall data is similar. You can see more key statistics, a fancier chart and a Buy/Sell button.

And to look like one of those movie stockbrokers, you can download Questrade Edge on your computer for the full, professional, (dark mode!) stock-trading experience. It’s jam-packed with charts, graphs and other information, which you can drag around on your screen.

And to top it all off, you’ve got Questrade’s mobile app, which allows you to trade stocks anywhere, anytime. The app is available on both the Apple Store and Google Play and is free to download. Design-wise, it reminded me quite a bit of the regular web version, except, well, mobile. Unfortunately, the simple version is the only one to choose from. If you want a lot of data, you’ll have to use a computer.

Customer Support

Questrade is a fully online stock broker. There are no branches if you need to talk to someone in-person. Support is available via phone 8:30 AM to 8 PM from Monday to Thursday, and from 8:30 AM to 5:30 PM on Friday. As for live chat, it is available from 9:00 AM to 4:45 PM from Monday to Friday. If you need help over the weekend, your out of luck.

Pros and Cons

- Low, variable trading commissions

- Offers a variety of trading platforms, all with a different level of complexity and features

- No monthly fees of any kind

- No commission on ETFs

- Allows you to hold money in CAD and USD

- Allows you to trade after hours

- Active trader pricing can reduce commissions for a monthly fee

- Support can be tricky to reach

- Only available to Canadian residents

- Charges a currency conversion fee

- Minimum of $1,000 balance to start trading

Summing Up – Is Questrade Worth It?

It’s time for the bottom line – do we recommend Questrade as your stockbroker of choice? The answer is yes, we do. Comissions are low, and your account chares no monthly fee. It allows you to trade on both US and Canadian markets in both US and Canadian dollars. The currency conversion fee is low, and you can trade after hours on US markets. You can also buy and sell ETFs for free.

My favourite part is the variety in trading experiences, which will please both beginner and advanced traders. The variable comission is also quite nice, as you only pay for how much you actually trade. In fact, my only real complaint is the $1,000 minimum balance they require to start trading.

If you don’t feel like Questrade is right for you, I’d strongly recommend checking out Wealthsimple, which we’ve examined in a seperate review.